虚拟货币mpt

2023年05月10日 16:15

欧易okx交易所下载

欧易交易所又称欧易OKX,是世界领先的数字资产交易所,主要面向全球用户提供比特币、莱特币、以太币等数字资产的现货和衍生品交易服务,通过使用区块链技术为全球交易者提供高级金融服务。

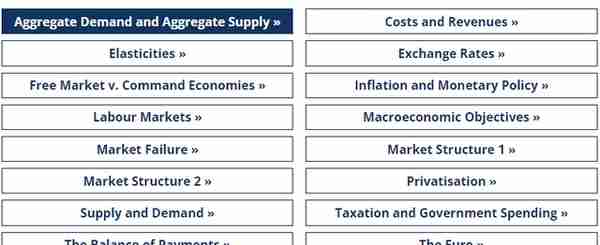

A-level economics revision guides and question banks covering labour markets, supply and demand, market structure and all core economics a-level topics.

以下内容我们会持续更新:

今天带给大家Alevel经济笔记是:

总需求和总供给篇-The '45 Degree' Diagram

Many of you will have spent quite a lot of time looking at '45 degree' diagrams, or 'Keynesian cross' diagrams.

Until a few years ago, they were the main way in that the expenditure and income aggregates where analysed.

Nowadays, aggregate demand and supply diagrams are preferred, although many teachers still like to explain the situation using the 'good old' 45-degree diagram.

It should be noted, though, that examiners prefer students to use aggregate demand and supply analysis (see the next three Learn-Its).

你们中的许多人会花费大量时间查看“45 度”图或“凯恩斯十字”图。直到几年前,它们还是分析支出和收入总额的主要方式。如今,总需求和供应图是首选,尽管许多教师仍然喜欢使用“好老”的 45 度图来解释情况。不过,应该注意的是,考官更喜欢学生使用总需求和供应分析(参见接下来的三个 Learn-It)。

On those grounds, I do not intend to spend too long on this. I do feel, though, that these diagrams are useful for explaining the concept of marginal propensity to consume (MPC).

This, in turn, is important for the understanding of the multiplier.

基于这些理由,我不打算在这上面花太长时间。不过,我确实觉得这些图表对于解释边际消费倾向 (MPC)的概念很有用。反过来,这对于理解乘数很重要。

The consumption function

Look at the diagram below.

You can see why this is called the 45-degree diagram. There is a line that comes diagonally out of the origin at an angle of 45 degrees. The reason why these diagrams have this 45-degree line is that for every point on the line, the value of whatever is being measured on the x-axis is equal to the value of whatever is being measured on the y-axis. In this case, that means that Y = C.

您可以看到为什么这被称为 45 度图。有一条线以 45 度角从原点对角线伸出。这些图表有这条 45 度线的原因是,对于线上的每个点,在 x 轴上测量的值等于在 y 轴上测量的值。在这种情况下,这意味着 Y = C。

Actually, this fact it not so important when dealing with consumption functions, but it is very important if the y-axis is measuring planned expenditure.

Equilibrium national income occurs where Y = E, and this would be every point on the 45 degree line.

实际上,这一事实在处理消费函数时并不那么重要,但如果 y 轴衡量计划支出,这一点就非常重要。均衡国民收入出现在 Y = E 的地方,这将是 45 度线上的每个点。

Anyway, the other line in the diagram is the one that represents consumption in the economy at each level of income.

For simplicity, we shall assume that we are dealing with a 2-sector model of the economy. Households either consume or save their income.

The line starts at point 'a'. This means that even when income is zero, consumption is 'a'. This is called autonomous consumption.

How can households consume if they have no income?

We have to assume that 'saving' is negative, or that 'dissaving' is going on.

In other words, households have to borrow money to consume, or dip into previously saved money, while they temporarily (one hopes!) have no income.

无论如何,图中的另一条线代表经济中每个收入水平的消费。为简单起见,我们假设我们正在处理经济的 2 部门模型。家庭要么消费,要么储蓄他们的收入。线从点'a'开始。这意味着即使收入为零,消费也是“a”。这叫做自主消费。没有收入的家庭如何消费?我们必须假设“储蓄”是负面的,或者“不储蓄”正在发生。换句话说,家庭不得不借钱消费,或者动用以前存的钱,而他们暂时(希望!)没有收入。

As income rises, consumption also rises. The gradient of the line represents something called the marginal propensity to consume.

This is the amount of every extra pound earned that is spent.

If you earned an extra £1, and spent 60p of it, then the value of the MPC would be 0.6.

Notice that if you spend 60p of an extra £1, you must, by definition, be saving the other 40p. Hence, the marginal propensity to save (MPS) will be 0.4. It should also make sense that MPC + MPS = 1.

随着收入的增加,消费也会增加。线的梯度代表一种叫做边际消费倾向的东西。这是所花费的每额外赚取的英镑的金额。如果您多赚了 1 英镑,并花费了其中的 60 便士,那么 MPC 的价值将为 0.6。请注意,如果您花费额外的 1 英镑中的 60 便士,根据定义,您必须节省另外的 40 便士。因此,边际储蓄倾向 (MPS) 将为 0.4。MPC + MPS = 1 也应该是有意义的。

Here are the formulas:

Notice that the consumption line has been labelled C = a + BY.

You may remember the equation of a line in GCSE maths (Y = MX + C).

The consumption equation is exactly the same structure.

'a' is the intercept point on the y-axis (autonomous consumption) and 'b' is the gradient (the MPC).

请注意,消耗线已标记为 C = a + BY。

您可能还记得 GCSE 数学中的直线方程(Y = MX + C)。

消费方程的结构完全相同。

'a' 是 y 轴上的截点(自主消耗),'b' 是梯度(MPC)。

This next diagram shows the relationship between the consumption function and the savings function.

下图显示了消费函数和储蓄函数之间的关系。

Where the consumption line crosses the 45 degree line, Y = C.

Hence savings must be zero. You can see that this is the case in the bottom diagram.

To the left of this point (Y1), C > Y, so saving must be negative.

Dissaving is occurring.

To the right of Y1, C < Y, so saving is positive.

Notice that since MPC + MPS =1, the gradient of the saving line is '1-b' where 'b' is the gradient of the consumption line.

在消费线与 45 度线相交的地方,Y = C。

因此储蓄必须为零。

您可以在下图中看到这种情况。

在这个点(Y 1)的左边,C > Y,所以储蓄一定是负的。

正在发生不储蓄。在 Y 1的右边,C < Y,所以储蓄是正的。

请注意,由于 MPC + MPS =1,储蓄线的梯度是“1-b”,其中“b”是消费线的梯度。

The MPC and the multiplier

The multiplier in the 2-sector economy

The multiplier is a very important concept in macroeconomics. The best way to explain the multiplier is to use a circular flow diagram.

乘数是宏观经济学中一个非常重要的概念。解释乘数的最好方法是使用循环流程图。

Assume an initial £100 million of autonomous investment. This money will return to the households in terms of income earned from the factors of production (land, labour and capital) hired to the firms (the black line).

It is assumed that the MPC = 0.8, and so the MPS = 0.2. Hence, households save 20% of this income. £20 million is saved and the rest is spent on the goods and services produced by the firms.

This £80 million again returns to the households in terms of factor incomes. 20% of this is saved (£16 million) leaving £64 million to be spent on goods and services.

This process keeps going. The initial £100 million will multiply to give a final increase in total national income of much more than £100 million.

In fact, there is a formula that you can use to find the multiplier, and then another formula that can be used to find the final increase in national income.

假设最初的自主投资为 1 亿英镑。这笔钱将以从企业雇佣的生产要素(土地、劳动力和资本)中获得的收入(黑线)返还给家庭。假设 MPC = 0.8,因此 MPS = 0.2。因此,家庭将这笔收入的 20% 存起来。节省了 2000 万英镑,其余用于公司生产的商品和服务。就要素收入而言,这 8000 万英镑再次返还给家庭。其中 20% 被节省(1600 万英镑),剩下 6400 万英镑用于商品和服务。这个过程一直在进行。最初的 1 亿英镑将成倍增长最终使国民总收入增加超过 1 亿英镑。事实上,有一个公式可以用来求乘数,然后另一个公式可以用来求国民收入的最终增长。

So, using the formulae, the value of the multiplier in the example above is 5 (1 divided by 0.2). The final increase in national income is £500 million (£100 million times 5).

The multiplier in the more realistic 4-sector model

If we now bring in the government and the foreign sectors, the multiplier works in the same way, but there are more withdrawals from the economy.

In this, more realistic, example, the MPC is still 0.8, giving a MPS of 0.2. We now assume that money is withdrawn from the economy via taxation and the purchase of imports.

在这个更现实的例子中,MPC 仍然是 0.8,给出 0.2 的 MPS。我们现在假设货币通过税收和购买进口商品从经济中撤出。

The marginal propensity to tax (MPT) is assumed to be 0.4 (the actual average tax paid by an individual is just under 40%). The marginal propensity to import (MPM) is assumed to be 0.2.

You can see from the diagram that with so many withdrawals, the amount of money that subsequently flows around the economy after the initial injection is much smaller. The higher the withdrawals, the lower the value of the multiplier.

In the 2-sector formula, we divided one by the MPS. In a sense, the MPS represented the marginal propensity to withdraw (MPW), because saving was the only withdrawal. The formula is the same for the 4-sector model, except we now have three withdrawals.

边际税收倾向 (MPT)假定为 0.4(个人实际缴纳的平均税款略低于 40%)。边际进口倾向 (MPM)假定为 0.2。从图中可以看出,由于提款次数如此之多,在初始注入后随后在经济中流动的资金量要少得多。提款越高,乘数越低。在 2 扇区公式中,我们将 1 除以 MPS。从某种意义上说,MPS代表了边际退出倾向(MPW),因为储蓄是唯一的取款方式。公式与 4 部门模型相同,只是我们现在有 3 个提款。

So, in the example above, adding the three marginal propensities to withdrawal gives 0.2 + 0.4 + 0.2 = 0.8. Hence the multiplier is one divided by 0.8, which equals 1.25. Finally, the total increase in national income is £125 million (£100 million times 1.25).

因此,在上面的示例中,将三个边际退出倾向相加得到 0.2 + 0.4 + 0.2 = 0.8。因此,乘数是 1 除以 0.8,等于 1.25。最后,国民收入的总增长为 1.25 亿英镑(1 亿英镑乘以 1.25)。

This example is much more realistic. The value of multipliers is rarely above 2 in the real world.

Even though the savings ratio is quite low in the UK (less than 10%), the tax burden is about 38%, and around 30% of GDP is spent on imports.

So you see, the MPW is likely to be well over 0.5, giving a value of the multiplier of less than two.

这个例子要现实得多。在现实世界中,乘数的值很少高于 2。尽管英国的储蓄率相当低(不到 10%),但税收负担却约为 38%,大约 30% 的 GDP 用于进口。所以你看,MPW 可能远远超过 0.5,乘数的值小于 2。

The concept of the multiplier is very powerful. For those who believe in the Keynesian 'demand management' way of running an economy, the idea that a given injection of money by the government can lead to a multiple increase in the final national income (and so the creation of more jobs) is very persuasive.

The important final point to note is that the process is a dynamic one. In the last example, the £100 million does not turn into £125 million overnight.

There will be a time lag between when the households receive their factor incomes and when it all gets spent. And then the money has to go round the circular flow again and again until the full £125 million is finally spent.

乘数的概念非常强大。对于那些相信凯恩斯主义的“需求管理”经济运行方式的人来说,政府注入一定的资金可以导致最终国民收入的成倍增长(从而创造更多的就业机会)的想法非常有说服力的。最后要注意的重要一点是,该过程是一个动态的过程。在最后一个例子中,1 亿英镑不会在一夜之间变成 1.25 亿英镑。从家庭获得要素收入到全部花光之间会有一个时间差。然后资金必须一次又一次地循环流动,直到最终花掉全部 1.25 亿英镑。

Remember that the multiplier process can work in reverse as well. When the German owned Rover decided to cut back its production in the UK, the resulting loss in jobs meant a reduction in consumer spending in the area, which will create further job losses in local shops that depended on the Rover employees' spending. Again this process can keep going.

请记住,乘数过程也可以反向工作。当德国拥有的罗孚决定削减其在英国的生产时,由此导致的工作岗位流失意味着该地区的消费者支出减少,这将导致依赖罗孚员工支出的当地商店进一步失业。同样,这个过程可以继续进行。

今天的Alevel经济笔记就更新到这里,如果大家对Alevel经济学感兴趣可以关注我们,

之前更新:

1、Alevel经济学习笔记:总需求和总供给篇-收入的循环流动

后续我们还会更新我以下版块的内容~

推荐阅读

标签: multiplier 消费 line

-

虚拟币平台差价买卖?虚拟币平台差价买卖违法吗

1970-01-01

As income rises, consumption also rises. The gradient of the...

-

国内虚拟货币挖矿停止(会产生重大影响吗?)

1970-01-01

As income rises, consumption also rises. The gradient of the...

-

浙江整治虚拟货币挖矿企业(浙江华冶矿建集团有限公司介绍)

1970-01-01

As income rises, consumption also rises. The gradient of the...

-

虚拟币用什么平台直播好 虚拟币用什么平台直播好呢

1970-01-01

As income rises, consumption also rises. The gradient of the...

-

关于政治虚拟货币的问题(欧美国家为什么没有禁止?)

1970-01-01

As income rises, consumption also rises. The gradient of the...

-

虚拟游戏币充值平台?虚拟游戏币充值平台有哪些

1970-01-01

As income rises, consumption also rises. The gradient of the...