Defined虚拟货币交易平台

2023年07月08日 15:53

欧易okx交易所下载

欧易交易所又称欧易OKX,是世界领先的数字资产交易所,主要面向全球用户提供比特币、莱特币、以太币等数字资产的现货和衍生品交易服务,通过使用区块链技术为全球交易者提供高级金融服务。

首先在看文章以前,想要了解对金融市场的最新资讯可以订阅我的油管频道Ravenrock 灰岩金融科技获取更多信息!

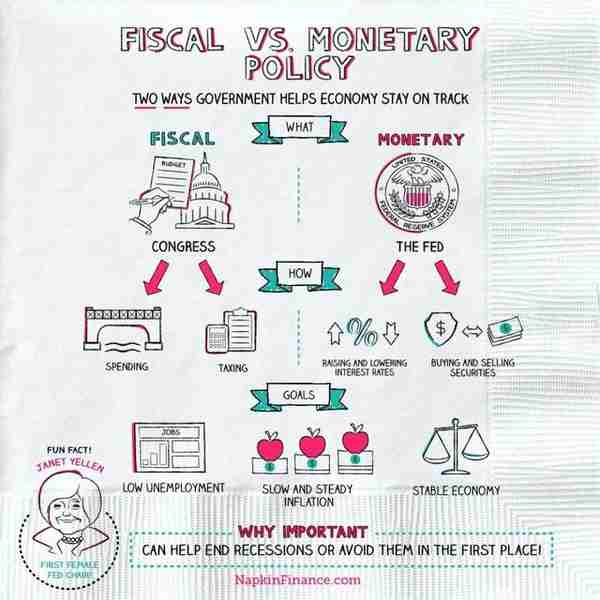

Non-Conventional Monetary Policies

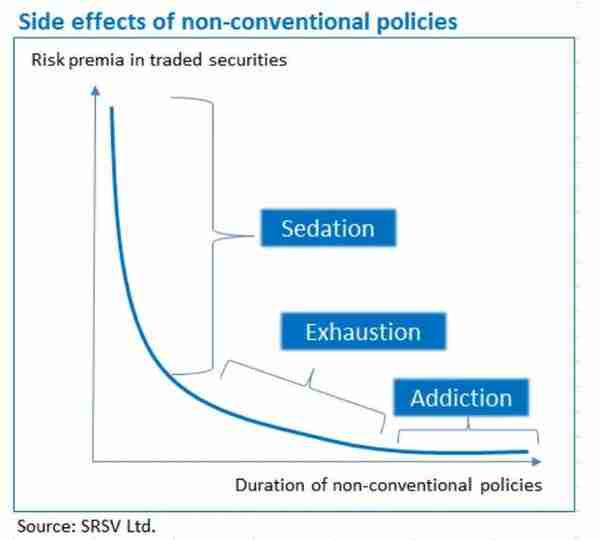

The operational frameworks of central banks have changed fundamentally in the wake of the great financial crisis. Non-conventional monetary policies have become the new normal in all large developed economies. Their main forms have been balance sheet expansion and risk premium compression through asset purchases and targeted lending, forward guidance in respect to future monetary policy, and changes to collateral rules. Future non-conventional policies could team up with fiscal expansion to create versions of “helicopter money”. Non-conventional policies have created new systemic risks, arising from [i] prolonged sedation of financial markets through containment of asset price volatility, [ii] exhaustion of scope for further monetary stimulus in future crises and [iii] addiction of economies to cheap funding.

非常规货币政策

在严重的金融危机之后,中央银行的运作框架发生了根本性的变化。非常规货币政策已成为所有大型发达经济体的新常态。它们的主要形式是资产负债表扩张和通过资产购买和定向贷款压缩风险溢价,对未来货币政策的前瞻性指导以及抵押规则的变更。未来的非常规政策可能会与财政扩张合作,以创建“直升机资金”版本。非常规政策已经产生了新的系统性风险,这些风险是:[i]通过控制资产价格波动来延长金融市场的镇静作用;[ii]在未来危机中用尽进一步刺激货币的空间;[iii]经济体倾向于廉价资金 。

A brief reminder of (what used to be) non-conventional monetary policy

Prior to the great financial crisis 2008-09, monetary policy in most developed economies operated mainly through short-term interest rates on special lending and borrowing facilities. The rough conceptual reference was the “Taylor rule”. A central bank would adjust its policy rate in accordance with changes in expected underlying inflation and economic growth. Exchange rates, money, and credit aggregates were widely monitored but not usually targeted directly.

对于历史以来非常规货币政策的简要总结

在2008-09年金融危机爆发之前,大多数发达经济体的货币政策主要通过特殊贷款和借贷利率的短期利率来运作。可供央行操作的理论指导是“泰勒规则”。中央银行将根据预期的潜在通货膨胀和经济增长的变化来调整其政策利率。汇率,货币和信贷总额受到广泛监控,但通常不直接针对。

The great financial crisis and the European sovereign crisis necessitated a transformation of the operational frameworks, mainly for two reasons:

- Policy rates approached their lower bounds but natural real rates of interest had also dropped to around zero, for both cyclical and structural reasons (view post here) and failed to recover after the crisis (view post here). Trapped at their lower bound policy rates lost the power to stabilize financial conditions in the face of further actual or potential adverse shocks. The consequence was a growing risk of inflation expectations becoming de-anchored (view post here) making economies particularly vulnerable to declines in goods and asset prices. Threats to price stability are asymmetric and skewed towards deflation (view post here) because unduly tight monetary policy is harder to correct and unduly easy policy. Moreover, there is a distinct risk of self-fulfilling dynamics: inflation expectations shift lower, real rates rise, debt burdens increase and consumption and pricing power soften (view post here). Economies are vulnerable even to shocks that were previously thought of as favorable, such as declines in import prices or labor costs (view post here).

- The systemic financial crises 2008-2012 obstructed monetary policy transmission and challenged central banks’ ability to stabilize financial conditions for non-banks. The popular concern was that monetary easing would be like “pushing on a string”: accommodative conventional monetary conditions no longer translated reliably into accommodative financial conditions for the economy as whole.

严重的金融危机和欧洲主权危机导致必须对央行运作的总体框架进行转型,这主要有两个原因:

政策利率已接近其下限,但由于周期性和结构性原因,自然实际利率也已降至零附近,并且在危机后未能恢复。面对进一步的实际或潜在不利冲击,陷入较低政策利率的困局丧失了稳定金融状况的能力。结果是通货膨胀预期被取消的风险越来越大,使经济体特别容易受到商品和资产价格下跌的影响。价格稳定的威胁是不对称的,并且倾向于通货紧缩,因为过度紧缩的货币政策难以纠正,过度宽松的政策也是如此。此外,存在自我实现动态的明显风险:通货膨胀预期降低,实际利率上升,债务负担增加以及消费和定价能力减弱。经济甚至容易受到以前认为有利的冲击,例如进口价格或劳动力成本的下降。

2008-2012年的系统性金融危机阻碍了货币政策的传递,并挑战了央行稳定非银行金融条件的能力。人们普遍担心的是,货币宽松就像是“推着一根细绳子一样艰难”:宽松的货币政策无法继续支撑起整个经济的金融条件。

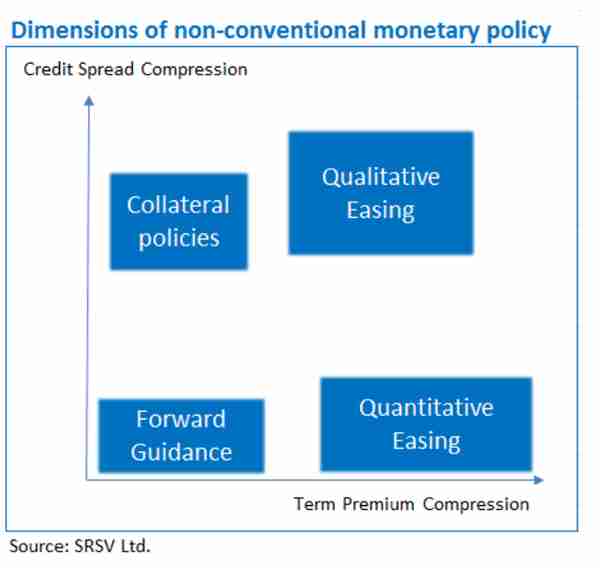

The “new normal” non-conventional monetary policies that evolved after the great financial crisis can be condensed into four principal categories:

- Forward guidance for policy rates means conditional or unconditional pre-commitment to future monetary policy rate levels. This policy uses institutional credibility to influence interest rates at longer maturities (view post here). All major developed market central banks have used explicit forward guidance since the great financial crisis.

- Quantitative easing denotes the expansion of the monetary base (central bank deposits and cash), typically through the purchase of government securities. The Bank of Japan was the first large modern central banks to deploy “QE” when it started buying JGBs (Japanese government bonds) in size in 2001. Quantitative easing on its own is not “printing money” because it constitutes an exchange of financial claims rather than purchase of goods and services against un-backed currency. It is distinct from the idea of helicopter money that is explained below. Moreover, not all central bank balance sheet expansions have been quantitative easing: a large part of ECB operations during the great financial and euro crises simply reflected the intermediation of a dysfunctional money market (view post here).

- Qualitative easing refers to the purchase of various types of assets for the purpose of risk premium compression, particularly the reduction of interest rate term premia and credit spreads. Qualitative and quantitative easing are often conjoined. One of the most powerful channels of non-conventional monetary policy is duration extraction, i.e. the combination of central banks’ balance sheet expansion and duration extension (view post here). Combined quantitative-qualitative easing also aims at compressing credit spreads. Thus, the ECB’s “Public Sector Purchase Programme” buys sovereign risk of very different quality (view post here). An example of pure qualitative easing would be the Federal Reserve’s “Maturity Extension Program”, which aimed at reducing term premia, and the ECB’s “Security Market Program”, which initially sterilized liquidity effects and hence only aimed at reducing longer-dated bond credit spreads and term premia.

- Collateral policies manage supply and pledgeability of collateral assets, which has greatly gained in importance since the great financial crisis (view post here) due to the expansion of collateralization in market transactions (view post here). Collateral policies influence financial conditions through the secured lending channel, for example by reducing risks of collateral shortages and secured funding constraints (view post here). For example, the broadening of eligible securities in ECB refinancing operations increased the pledgeability of collateral of euro area banks (view post here). Also, the U.S. “Term Securities Lending Facility” increased the supply of Treasury general collateral to primary dealers at the height of the great financial crisis.

在严重的金融危机之后形成的“新常态”非常规货币政策可以归纳为四个主要类别:

窗口指导政策指导意味着对未来货币政策利率水平的有条件或无条件的预先承诺。该政策利用机构信誉来影响较长期限的利率。自金融危机以来,所有主要的发达市场中央银行都使用了明确的窗口指导政策。

量化宽松表示货币基础(中央银行存款和现金)的扩张,通常是通过购买政府证券来实现的。日本银行是2001年开始购买规模较大的日本国债(JGBs)时,是最早部署“QE”的大型现代中央银行。量化宽松本身并不是“印钞”,因为它构成了金融债权的交换。而不是用无抵押货币购买商品和服务。这与下面解释的“直升机赚钱”的概念不同。此外,并非所有央行资产负债表的扩张都是量化宽松的:在金融危机和欧元危机期间,欧洲央行的大部分业务都只是反映了功能失调的货币市场的中介作用。

质化宽松是指为压缩资产本身的风险溢价而购买的各类资产,特别是降低利率期限溢价和信贷利差。质化和量化宽松经常结合在一起。非常规货币政策最强大的渠道之一是期限提取,即中央银行资产负债表扩张和期限延长的结合。结合定性和定量的宽松政策还旨在压缩信贷息差。因此,欧洲央行的“公共部门购买计划”购买了质量完全不同的主权风险。纯质化宽松政策的一个例子是美联储旨在降低长期溢价的“期限(到期日)延长计划”,以及欧洲央行的“证券市场计划”,其最初是消除了流动性影响,因此仅旨在降低长期债券信用利差。和足月溢价。

抵押品政策意味着央行拥有着抵押资产的供应和可抵押性,自从发生巨大的金融危机以来,由于市场交易中抵押的扩大,抵押政策变得越来越重要。抵押品政策通过有担保的借贷渠道影响财务状况,例如,通过减少抵押品短缺和有担保的资金约束的风险。例如,欧洲央行再融资业务中合格证券的扩大增加了欧元区银行抵押品的质押性。此外,在金融危机最严重的时候,美国的“定期证券借贷机制”增加了向一级交易商提供的美国国债一般抵押品的供应。

Some economists also classify negative nominal interest rates as a non-conventional policy. Modestly negative rates have been introduced in several developed countries and seem to transmit to the rest of money market and capital market rates for the most part much like positive rates do. However, negative policy rates bear risks for the profitability and functioning of the financial system (view post here) and seem to have downside limits at present. It has technically become possible to reduce policy rates even deeply negative (view post here). One approach would be to levy a variable deposit fee at the central bank cash window to enforce value decay of paper currency relative to electronic money (view post here). However, a new policy of this type would require considerable economic pressure and preparation.

If current non-conventional monetary policies fail to secure inflation targets or to avoid deflation, some form of debt monetization or “helicopter money”, i.e. direct monetary transfers to non-banks, may be considered as policy option (view post here). The barriers for this in the U.S., the euro area and Japan are high but not insurmountable. This policy could work through fiscal expansion backed by outright central bank funding or restructuring of sovereign debt currently held by central banks. “Helicopter money” should have a more direct impact on actual inflation and long-term inflation expectations than central banks’ operations with the financial system (view post here).

一些经济学家还将负名义利率政策定性为非常规政策。几个发达国家已经引入了适度的负利率,并且似乎在很大程度上像正利率一样转移到了其余的货币市场和资本市场利率。但是,负政策利率会给金融系统的盈利能力和功能带来风险,并且目前似乎存在下行限制。从技术角度来看,降低政策利率甚至有可能成为消极的可能性。一种方法是在中央银行的现金窗口中征收浮动存款费用,以强制纸币相对于电子货币贬值。但是,这种新政策将需要相当大的经济压力和准备。

如果当前的非常规货币政策无法确保通胀目标或避免通缩,则可以将某种形式的债务货币化或“直升机撒钱”,即直接将货币以及资金注入并转移至非银行机构,这也是一种可供选择的货币工具以及政策。美国,欧元区和日本的法律壁垒很高,但并非无法克服。该政策可以通过由中央银行直接提供资金支持的财政扩张或由中央银行目前持有的主权债务重组来实现。与中央银行在金融体系中的运作相比,“直升机资金”对实际通胀和长期通胀预期的影响应更为深远以及直接。

“The problem with QE is that it works in practice, but it doesn’t work in theory.”

Ben Bernanke, Federal Reserve Chairman, 2014

“量化宽松的问题在于它可以在实践中起作用,但在理论上却不起作用。”

~本·伯南克(Ben Bernanke),美联储主席,2014年

The impact on systemic risk

系统性风险对于宏观经济的冲击

The three systemic consequences

Non-conventional monetary policies have altered the nature of systemic risk. Markets have learnt to rely upon these policies and their effects are pervasive across the risk spectrum. Some systemic consequences have already become apparent. One can condense these into the issues of “sedation”, “exhaustion” and “addiction”:

三大系统性后果

非常规货币政策改变了系统性风险的性质。金融市场本身已经过于依赖这些政策,其影响在整个风险范围内无处不在。一些系统性后果已经变得显而易见。如同患者摄入药物的反应一般,我们可以将它们浓缩为“镇静”,“疲惫”和“成瘾”几种:

- Sedation: Non-conventional policies suppress market volatility by design and compromise the financial system’s capacity to manage risk. Empirical evidence suggests that central banks have long used policy rates to stabilize financial markets in times of distress (view post here). However, after the great financial crisis central banks’ grip on market volatility has become tighter. Near-zero policy rates with forward guidance have suppressed short-term rates volatility and, thereby, helped to dampen equity return volatility (view post here). Moreover, policy interventions now affect prices in a broad range of securities markets, particularly in long-term bond markets (view post here). Protracted suppression of volatility typically fosters undue leverage through endogenous market dynamics, such as “collateral amplification” (view post here). Constrained volatility also creates a false sense of the robustness of conventional statistical risk metrics (view post here) and may even impair investment professionals’ personal resilience in the face market distress (view post here).

镇静:非常规政策通过设计抑制市场波动,并损害金融系统的风险管理能力。经验证据表明,在困境时期,中央银行长期以来一直使用政策利率来稳定金融市场。但是,在严重的金融危机之后,各国央行对市场波动的控制越来越严格。透过央行的窗口指导,前瞻性零利率政策抑制了市场短期利率的波动,从而有助于抑制股票收益率的波动。此外,政策干预现在影响着广泛证券市场中的价格,尤其是长期债券市场中的价格。持续抑制波动通常会通过诸如“抵押放大”之类的内在市场动态来培养过度的杠杆作用。波动性的限制也会使人们对传统的统计风险指标的稳健性产生错误的认识(甚至可以削弱投资专家在面对市场困境时的个人应变能力)。

- Exhaustion: Non-conventional policies become less effective over time. Yields, credit spreads, and term premia all have effective lower bounds and the more compressed they become, the less incremental economic support can be provided through reducing them (view post here). Also, yield compression cannot easily be reversed in times of economic improvement, because low-yield periods naturally come with enhanced leverage (view post here) and economic vulnerability to monetary tightening (view post here and here). This drives the scope for yield, term and credit premia compression naturally to a point of exhaustion.

- Moreover, there are constraints on the volume of central bank interventions. Liquidity issues have become an increasing concern as central banks have taken a sizeable share of some types of bonds from the market. Legal limitations can arise from restrictions on the eligibility of securities for central bank interventions and prohibitions of outright government financing (view post here).

- Finally, ultra-low and or even negative real interest rates pose risk to profitability and financial health of the financial system (view post here). Asset purchases flatten the yield curve and reduce banks’ returns on maturity transformation and credit risk. Beyond, negative monetary policy rates undermine financial transmission, because they encourage cash hoarding and reduce the profitability of traditional banking. This danger increases with depth and duration of negative interest rate policies. This has necessitated the creation of tiered reserve systems in some countries (view post here). Tiered reserve systems effectively exempt a part of banks’ excess reserves from negative rates, allowing negative interest rates to go deeper and longer.

- Meanwhile, life insurance companies and defined-benefit pension funds, whose liabilities typically have a longer maturity than their assets, have come under pressure from deteriorating funding ratios and net cash flows (view post here). This pressure could become worse if interest rates refuse to recover and financial markets suffer new deflationary shocks.

- Addiction: Financial institutions have overtime become more dependent on non-conventional ‘life support’, particularly on cheap funding and explicit credit market stabilization programs.

- Global financial leverage further increased after the great financial crisis, notwithstanding declining debt service capacity of public and private borrowers due to diminishing expected nominal GDP growth (view post here). Central banks can alleviate acute liquidity stress but cannot easily de-lever the financial system. As a consequence of high leverage, institutional credit and money markets have remained fragile, i.e. vulnerable to self-reinforcing dynamics between asset prices and funding conditions (view post here). Also, the financial system has much greater exposure to government bond yield risk than in the past (view post here), as highlighted in episodes of government bond yield surges, such as the Japanese bond yield rise in 2013, the U.S. treasury sell-off (“taper tantrum”) in summer 2013 (view post here) and the German government bonds sell-off (“bunds tantrum”) in spring 2015. This is in line with numerous historical examples of easy monetary policy leading to financial booms and subsequent crises (view post here).

- There is also evidence that the financial system has adapted to low fixed income yields and suppressed volatility by expanding explicit and implicit short volatility strategies (view post here). Short-volatility positions bear explicit or implicit volatility, “gamma” and correlation risks and include popular strategies such as leveraged risk parity and share buybacks. Their expansion probably created two dangerous feedback loops. The first is a positive reinforcement between interest rates and volatility that will overshadow central banks’ attempts to normalize policy rates. The second is a positive reinforcement between measured volatility and the effective scale of short-volatility positions that has increased the risk of escalatory market volatility spirals in the future.

政策有效性的枯竭:随着时间的推移,非常规政策的有效性降低。收益率,信贷利差和长期溢价都有有效的下限,并且它们变得越压缩,通过减少它们可以提供的增量经济支持就越少。同样,在经济改善时,收益率压缩很难轻易逆转,因为低收益期自然会伴随着杠杆率的提高和经济紧缩货币的脆弱性。这自然将产量,长期和信贷溢价压缩的范围推到了精疲力竭的地步。

此外,中央银行政策干预的频率以及规模也受到限制。随着各国央行从市场上购买了相当数量的某些类型的债券,流动性问题变得越来越令人担忧。限制中央银行干预的证券资格以及禁止直接政府融资的法律限制可能会产生。

最后,超低甚至是负的实际利率会对金融系统的盈利能力和财务健康构成风险。资产购买使收益率曲线趋于平坦,并减少了银行在到期日转换和信用风险方面的回报。除此之外,负的货币政策利率会破坏金融传导,因为它们会鼓励现金ho积并降低传统银行业务的利润率。这种风险随着负利率政策的深度和持续时间而增加。这就需要在一些国家建立分层的储备系统。分层准备金制度可以有效地免除部分银行超额准备金的负利率,从而使负利率变得越来越深。

同时,人寿保险公司和定额养恤金基金的债务通常比其资产具有更长的到期日,因此它们受到资金比率和净现金流恶化的压力。如果利率拒绝恢复并且金融市场遭受新的通缩冲击,这种压力可能会变得更糟。

对货币政策上瘾:金融机构加班越来越依赖于央行注入的非常规的“生命支持”,尤其是廉价的资金和明确的信贷市场稳定计划。

尽管发生了严重的金融危机,但由于名义GDP增长预期下降,公共和私人借款人的偿债能力下降,因此全球金融杠杆进一步增加。中央银行可以缓解严重的流动性压力,但不能轻易地使金融体系失去杠杆作用。由于高杠杆率,机构信贷和货币市场仍然脆弱,即容易受到资产价格和融资条件之间自我强化的影响。此外,与政府债券收益率风险相比,金融体系的风险敞口要大得多(如政府债券收益率激增的事件所突出显示,例如2013年日本债券收益率上升,美国国库券抛售) 于2013年夏季和2015年春季的德国政府债券抛售。这与众多宽松货币政策导致金融繁荣和随后的泡沫破碎甚至是金融危机的历史例子相吻合。。

也有证据表明,金融系统通过扩大显性和隐性的短期波动率策略,已经适应了低固定收益收益率并抑制了波动率。短期波动仓位具有明示或暗示的波动率,“伽玛”和相关风险,并包括受欢迎的策略,例如杠杆风险平价和股票回购。它们的扩展可能会产生两个危险的反馈循环。首先是利率和波幅之间的积极加强,这将使央行试图使政策利率正常化的努力蒙上阴影。第二点是在测得的波动率和空头波动率头寸的有效规模之间的积极加强,这增加了未来市场波动加剧的风险。

A reversal of the monetary policy cycle can lead to a disproportionate adjustment in global long-term yields. Research suggests that the term premia in global government bond markets have broadly turned negative in the 2010s, a historic shift that was fostered by policy support for a global duration carry trade (view post here). There is also evidence that monetary policy has precipitated structural shifts in interbank and high-grade bond markets that escalated demand for “safe bonds” and compressed yields further (view post here). Also, some studies suggest that inflation risk premia have turned negative (view post here and here) in large developed countries, with significant spillover to other countries. Conversely, quantitative estimates suggest that a rebound of term premia in a large dominant market, like the U.S., would put upward pressure on borrowing costs in virtually every economy around the globe, whether its local financial stability can withstand it or not (view post here).

There are hopes that macroprudential measures might offset the addictive quality of ultra-easy monetary policy in the developed world, as they rein in financial risk-taking (view post here). However, macroprudential policies are largely new and untested, have worked best as a complement (not offset) to monetary policy. Also, they often focus on specific sectors only, such as banking and housing (view post here).

货币政策周期的逆转可能导致全球长期收益率的不成比例的调整。研究表明,全球政府债券市场上的溢价一词在2010年代已大体上变成了负数,这是历史性的转变,这是由于对全球期限套利交易的政策支持所致。也有证据表明,货币政策已导致银行间和高等级债券市场发生结构性转变,从而加剧了对“安全债券”的需求,并进一步压缩了收益率。

此外,一些研究表明,在大型发达国家中,通货膨胀风险溢价已变为负面,并且大量溢出到其他国家。相反,定量估计表明,像美国这样的大型主导市场上的长期溢价回升,将对全球几乎每个经济体的借贷成本造成上行压力,无论其当地金融稳定性能否承受。

有希望的是,宏观审慎措施可能会遏制发达国家中超宽松货币政策的令人上瘾的质量,因为它们会遏制金融风险。但是,宏观审慎政策在很大程度上是新的且未经检验,作为对货币政策的补充(而不是抵消)效果最好。此外,他们通常只关注特定领域,例如银行和住房。

“We do see that real estate dynamics or high household debt levels in some countries signal the risk of increasing imbalances…they relate to the continued very high level of household indebtedness and the low level of mortgage collateralisation…That being said, monetary policy is not the appropriate tool for addressing local and sectoral financial risks. Rather, targeted macroprudential policies, which can be tailored to local and sectoral conditions, are the right answer.”

Mario Draghi, March 2017

“我们确实看到某些国家的房地产动态或高家庭债务水平预示着失衡加剧的风险……这与持续高水平的家庭债务和低水平的抵押抵押品有关……也就是说,货币政策并非 解决本地和部门财务风险的适当工具。

相反,可以针对当地和部门情况量身定制的有针对性的宏观审慎政策是正确的答案。”~ 马里奥·德拉吉(Mario Draghi),2017年3月

推荐阅读

- 上一篇:2022学校的kyc(2021学校)

- 下一篇:a贝虚拟货币走势

-

奥斯卡虚拟货币怎么买(BUCKS是什么)

1970-01-01

The “new normal” non-conventional monetary policies that evo...

-

游戏虚拟币交易平台?虚拟货币交易用什么软件

1970-01-01

The “new normal” non-conventional monetary policies that evo...

-

陕西虚拟货币挖矿举报平台,12369举报范围

1970-01-01

The “new normal” non-conventional monetary policies that evo...

-

乡镇虚拟货币挖矿排查情况 (虚拟货币)挖矿犯不犯法?

1970-01-01

The “new normal” non-conventional monetary policies that evo...

-

最近大涨虚拟货币,虚拟币最近为何大幅上涨?

1970-01-01

The “new normal” non-conventional monetary policies that evo...

-

虚拟货币外围资金是什么,外围指数怎么还在变动

1970-01-01

The “new normal” non-conventional monetary policies that evo...